Digital Marketing for the Financial Industry

Grow your brand through digital marketing.

Your biggest challenge as a small mortgage lender is standing out among the domineering industry players, especially considering that the top three banks loaned 50% of all new mortgage money in the U.S. When you throw in non-bank lenders, small lenders have a minimal portion to scramble over. But that shouldn't get you down. You might not have the marketing muscle of the mainstream players, but you do have digital marketing.

There are simple and effective things you can do that will make you stand out, grow your brand, and your market share.

Get Your Audience Right

Your first step in your digital marketing should be identifying your ideal audience. Targeting the wrong crowd is like running into a brick wall. No matter how much effort you put in, the result is always the same – nothing!

Reassess your current practices to ensure you focus your engines on the right clients. A nifty and helpful way to go about this is to create "customer personas." Creating the personas is tedious. But once you have them in place, your loan officers can quickly go through the templates to identify quality leads.

Leverage Various Types of Media

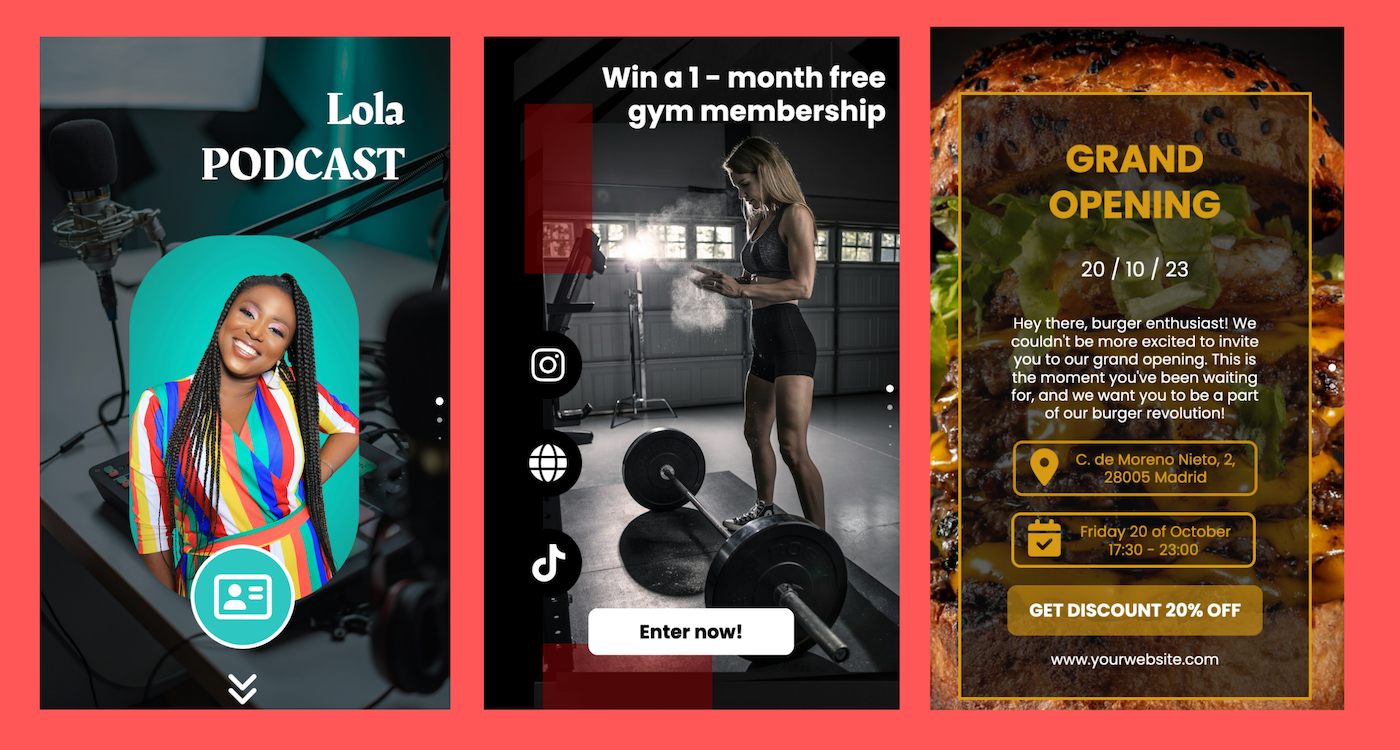

Once you know your type of audience, you can come swinging for the fences from all angles. It's easy to get fixated on one kind of media, especially if it is working for you at the moment. But you will be leaving tons of leads on the table when you don't use other media types.

Incorporate videos and images into your digital marketing campaign as well. Currently, the attention span of digital consumers is shorter than that of a goldfish. You need creative videos to hook your audience and keep them coming back. Catchy and funny adverts are a great place to start and stand out.

You can also use video to make your business more personable. Case in point – using video on your "About Us" to introduce your team.

Get Creative on Your Website

Placing an occasional advert in the newspapers has its benefits. But if you're going to flourish in the modern world, a creative, functional, and responsive website is like a lifeline.

If you don't have a website, your leads will go to the next loan officer with an online presence. If you have a website, it's possibly time to have a second look at it. Does it have those dated images? Does it say so much about yourself and practically nothing about how you can help your traffic? Is it only accessible on a desktop? Does it feel like it was designed in the 90s? If the answer to any of these questions is yes, you need to revamp your website to make it more effective.

Social Media is Your Friend

Social media is the easiest way to get your brand in front of millions of eyes – And for (almost) free! Sure, there are billions of people and possibly thousands of other small and independent mortgage lenders. But that's the beauty. The numbers are so astronomical that you will likely get a few hundred likes the first week, if you strike the right chords.

Work on several social media platforms. Focus on those that are popular with your target audience. Don't take things too seriously on social media. Focus on sharing fun and actionable content. Once in a while, you can share a heart-warming story of how your brand impacts people's lives. That will definitely get you noticed and land you more leads.

Encourage Your Clients to Leave Reviews

Most clients will scour the internet for reviews on your brand before contacting you. Encourage your clients to leave reviews and when they do, highlight them. Potential leads are more receptive to information provided by other customers.

In the process, expect to land a few negative comments. Don't take them as a jab at your business. Instead, you can use the feedback to improve your customer service. Customer feedback also works as a great assessment tool to identify if loan officers doing an excellent job.

Build Your Customer Loyalty Through Digital Marketing

Don't let your business suffocate under the stranglehold of the large mortgage lenders. There are simple and cost-effective measures that you can take right now to upgrade your digital presence today to win more sales and build customer loyalty. All you have to do is start acting now and be consistent, and your effort will start paying off.

Contact us today to learn how you can leverage marketing opportunities to be ahead of the curve.